We’re pleased to announce that Readysell 8.59 (codename “Macleay”) is rolling out progressively to all of our Readysell 8 customers. This release is focused on implementing some important service enhancements, improvements to the framework of the whole application, and actioning bugs that have been reported over the last period.

New feature Development

16173 – Added the ability to specify a tender in the sale shipment API

16201 – Web Order API can now generate eGift Voucher numbers and shipment/invoice

16205 – Added user setting to return only new products or no products to the mobile app

16227 – (applicable to particular customers) – Added Integrity check for Gift Vouchers that are retrieved from POS manually

16238 – (applicable to particular customers) – Updated Integration for upcoming Order XML Changes

Bug Fixed:

15728 – Reworded a validation message when trying to close a service order and the period is already closed

15911 – Fixed an issue whereToner pools/Toner tracking was not getting triggered if the supply level equalled zero

15927 – Fixed missing toner levels for print Audit

16081 – Removed the leading zeros from Ingram micro supplier product ID from RS3 feed

16189 – Fixed an issue when creating invoice from CreateShipment API resulting in the invoice having the wrong transaction type

16192 – (applicable to particular customers) – Fixed an issue where integrated product upload wouldn’t finish. This has been moved into its own task

16216 – Fixed an issue where ESD CustomerAccountAddresses returned isPostal value instead of isPrimary value

16219 – Fixed an issue where the same two tasks could run in parallel

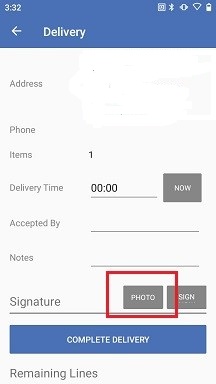

16239 – Resolved an issue where manual Qty Scan was disabled for Shipments with a status of InProgress

*Note: the referenced POS is a standalone POS, only relevant for a particular set of customers. These features are not relevant to the Readysell POS functionality.